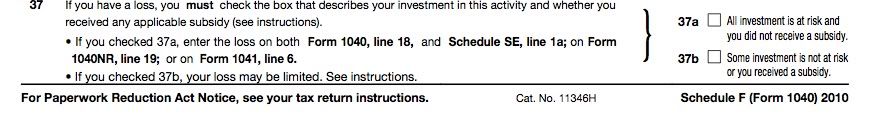

Had a few questions for those that have done this before, this is my first year filing taxes with a farm. So on my place I have cash rent and CRP income. I then have my list of expenses and interest on the farm, which does account for a loss. So when I fill out Form 4835 "Farm Rental Income and Expenses", I have my net loss for the farm but for some some reason the computer makes me check a box that says "Some investment is not at risk". I was told I had to fill out Form 8582, "Passive Activity Loss Limitations", which asks you if all of your investment is at risk, to which I answered yes. However, when it runs it through it says not all of it is and it substantially limits the amount of losses I can deduct based on the amount in the "Passive Activity Loss Limitations" form. So anyway, does this sound right to someone who has done this before? Am I even using the right forms for a situation like mine? Thanks.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

cedar creek

Banned

You hit the nail on the head.Schedule F if you have production risk, otherwise it is rental income. Lots of accountants bend the rules when it comes to farms though.

It is limiting your loss because it is a passive income/loss. Short answer...your income is not at risk. The rental income is guaranteed to you. No/less risk so the IRS limits the amount of loss you can have. Have someone custom farm the tillable acres outside of CRP and it will open up more options for you.

Yeah I did, but I am not sure I am buying the way they are currently done....I'm not an accountant. You'd be money ahead to spend a couple hundred and have an accountant prepare your taxes.

Yeah I did, but I am not sure I am buying the way they are currently done.

I'm certain you could find an accountant that would allow you to claim all the expenses. Doesn't make it right, but I'm sure you could find one. If the extra expenses are a big deal, you should have the tillable acres custom farmed, or possibly even 50/50 crop share.

MK M GOBL said:I'm certain you could find an accountant that would allow you to claim all the expenses. Doesn't make it right, but I'm sure you could find one. If the extra expenses are a big deal, you should have the tillable acres custom farmed, or possibly even 50/50 crop share.

Not really a big deal and I fully plan on doing it the correct way. I just want to understand how that is. Thanks.

singlecoyote

Proud member of the IBA

Hire an accountant that owns a farm. Thats what I did. Well worth it in my opinion. :drink1:

If you rent out your ground you use the 4835 form if you actually are the operator of the farm you use Schedule F form.

If you rent out your ground you use the 4835 form if you actually are the operator of the farm you use Schedule F form.

Not really a big deal and I fully plan on doing it the correct way. I just want to understand how that is. Thanks.

When did you get a conscience???:drink2:

When did you get a conscience???:drink2:

When it could cost me my job